The popularity of payday loans in the US has drastically increased recently. Why? What makes them so prominent in the lending industry? The reasons for being so much spoken about are spinning around their contradictory nature that embraces availability and somewhat higher interest rates. Let’s get down to deets to have a better understanding of these loans.

A payday loan is a type of borrowing available in small amounts and is usually lent with a short repayment period (from two weeks up to a few months); that is why they are often defined as short-term small-amount loans. The maximum amount for these types of loans doesn’t exceed $2500, which should be due on the borrower's next paycheck. These loans are not collateralized. Thus you don’t need to secure the borrowed money against any asset. Besides, even the borrowers whose credit score is far from being excellent can apply.

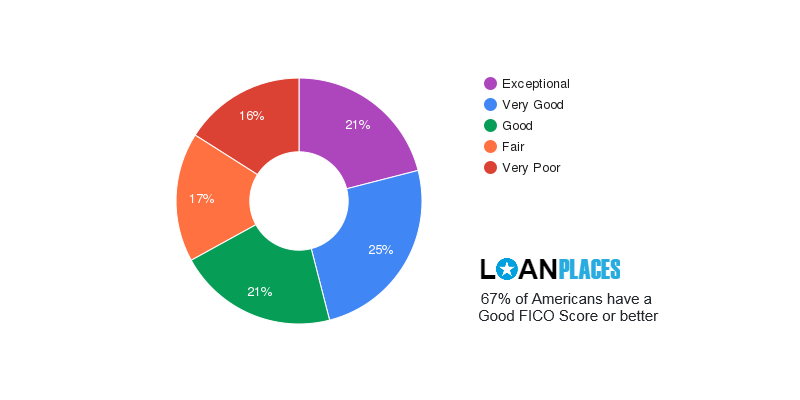

One of the main benefits of payday lending is the consideration of your current financial portfolio, as there are lenders that may put your stable source of income above your credit score. In comparison, traditional lenders consider your credit history beyond your ability to pay off the debts. Thus, a low credit score becomes one of the crucial factors for the banks that determine whether you will be approved for the loan or not. Payday lenders offer short-term small-amount loans to borrowers with a credit score that is below 680 according to the FICO® (Fair Isaac Corporation) score. FICO Scores range from 300 to 800 and help better understand your credit history and payment capacity. The higher the number, the more appealing your credit portfolio may seem to the lenders, and correspondingly, the lower scores most often end up with a loan refusal.

As we see, 67% of Americans have a good FICO score and can easily apply and get any credit, while 33% of Americans miss out on overcoming the threshold of getting a bank loan. They may decide whether to bring a co-signer and apply for a bank loan or adhere to online lending platforms — it’s a Hobson's choice. A co-signer is a person who applies together with the borrower for a loan. At first, sight getting a co-signer may seem a cakewalk, but there are pitfalls you overlook. In case you fail to make timely payments, your co-signer will ruin his credit history. Thus, getting a co-signer is very risky, and not everyone can take the plunge and bank on online lenders. In the case of payday lending, you need neither a co-signer nor collateral.

As we see, 67% of Americans have a good FICO score and can easily apply and get any credit, while 33% of Americans miss out on overcoming the threshold of getting a bank loan. They may decide whether to bring a co-signer and apply for a bank loan or adhere to online lending platforms — it’s a Hobson's choice. A co-signer is a person who applies together with the borrower for a loan. At first, sight getting a co-signer may seem a cakewalk, but there are pitfalls you overlook. In case you fail to make timely payments, your co-signer will ruin his credit history. Thus, getting a co-signer is very risky, and not everyone can take the plunge and bank on online lenders. In the case of payday lending, you need neither a co-signer nor collateral.Payday loans are available for US residents who are 18 years of age and can provide proof of income, an active bank account, and an authentic ID. These financial tools come with flexible lending criteria. It means that borrowers' applications on low-income or with a poor credit history may also be approved.

Note: The terms and conditions and the approval rates differ from lender to lender.

We have compiled a list of online lending platforms that are well-known for their high-acceptance requests. Our motivation is to educate our customers and help them make knowledgeable decisions to better their future. Shop around and compare their offers to find out the one that most suits your exact case.

| Lender | Learn More | Rating⚹ | Max. Loan Amount | Min. Credit Score |

|  |  | $2,000 | 600 |

|  |  | $2,500 | Not Specified |

|  |  | $2,500 | Not Specified |

|  |  | $2,000 | 600 |

|  |  | $2,500 | 580 |

Payday loans are available for US residents who reached 18 years of age and can prove income. The processing of the loan is effortless and quick. No matter where you are, you can fill out the online request just on the spot. By providing personal information (name, phone number checking account number, ID number), you will have a chance to be reviewed by many lenders. How? We will do the job for you. When you apply, we redirect your request to our lenders, who will get in touch with you as soon as they review your data. After getting the approval, the funds will be transferred into your bank account without delay. On the due date, you have to repay the borrowed sum in full, together with interests.

Double-check your bank statements: Before applying for these short-term loans, make sure to check your recent bank reports. Be informed that gambling transactions may also be an issue.

Don’t accept the first offer from the lender: Before making the final loan decision, review several offers, compare the APRs (Annual Percentage Rate), repayment terms, and consider possible implications in the case of repayment delays.

Provide all the information required in the application form: Make sure to provide valid data regarding your address, telephone number, sources of income, employment, etc.

Don’t apply for several loans at the same time: Multiple loan requests may indicate that you are in dire need and may consider you an insolvent debtor. And your loan application will end up with a refusal.

These types of loan products come with relatively high-interest rates, and if you don’t want to slide into debts, you should ponder over some questions: would you be able to pay the debt back together with interests next month? Are you going to tighten your purse strings, or maybe you plan to have an extra income? Be informed that if you want to take out payday loans to pay off other loans or buy new clothes, it is not the right choice, and it can make the situation even worse. Payday loans should be used if you have tried all the other options of getting money (turning to banks, borrowing from relatives, or friends).

| The Bottom Line |

Irrespective of the fact that traditional lending entities (banks and credit unions) offer affordable alternatives to payday loans, they are not available to most people, especially when their credit score is not in good health. If used reasonably, paycheck loans can tide you over until your next payday.

[ Updated on 20-Oct-2021, 07:47 ]