Bad credit is the key factor that takes the credit for millions of rejected loan applications. The bad credit holder label is a signal that you are in a pinch, and the banks consider you a risky borrower. They don’t want to put their resources at stake. Ahead you will find answers to a burning question: what bad credit is.Bad Credit in a Nutshell

While deciding whether to accept your loan request or not, the lenders consider your credit score. According to the FICO (Fair Isaac and Company), a credit score is a digital expression of your credit history (incorporates all the ups and downs of the credit history, multiple loans, employment history as job-hoppers usually have poor credit, irregular income, etc.) that ranges from 300 to 850. If your score totals 650 or is over, then your credit is good. The lower the number, the less creditworthy you are; you have bad credit, in other words.

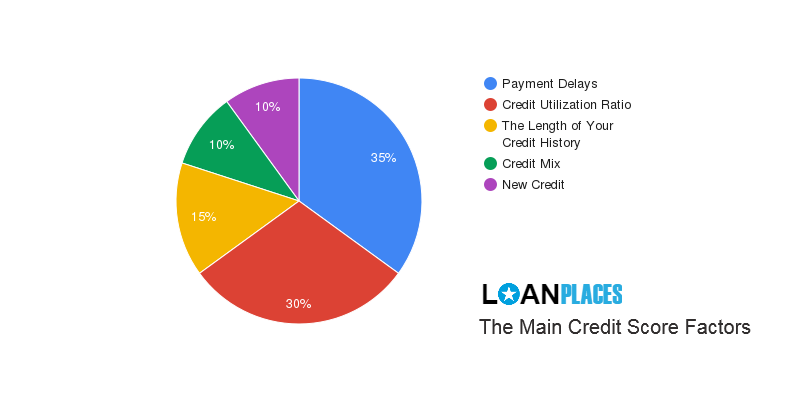

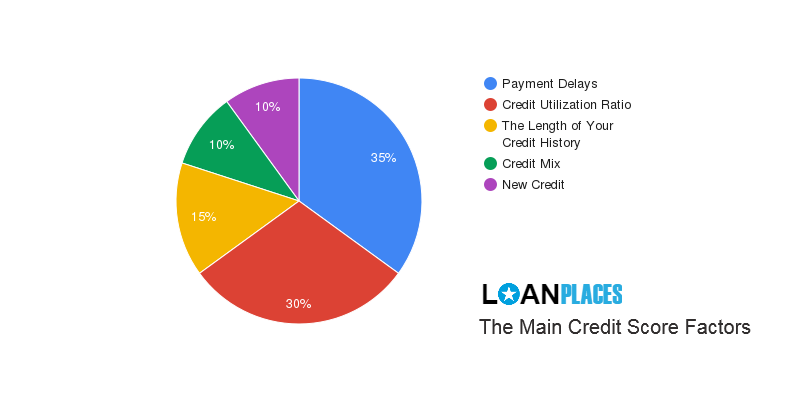

Let’s consider the main factors that affect your credit score:

Payment Delays

35% of your credit score occupies your credit history. Any credit default is reported to credit bureaus. Thus, your every late payment to creditors or utility providers might be illustrated in your credit report reducing your chances of getting loan approval.

Credit Utilization Ratio

30% of your score takes account for the total amount you owe compared to your debts. Be aware that your available credit determines your financial stability and the ability to pay the debt back. The less the credit utilization ratio, the higher your score may be.

The Length of Your Credit History

Have you ever thought of the age of your old accounts? Be informed that the age of the latter may play a significant role in your score. How? 15% of your credit score belongs to the length of your credit history. Long credit history is undoubtedly useful if you don’t have any spots there. Financial gurus advise living credit cards open. Even if you don’t want to use them, it will surely increase your FICO score.

New Credit

10% of your credit score belongs to your new credits. Every time you apply for a loan, the lenders carry out hard credit inquiries that may cause a short drop in your credit history as you may be considered a risky borrower. It’s that simple — the borrowers apply for many credits when they face financial hardships.

Credit Mix

10% of your FICO Score belongs to a credit mix. A credit mix comprises various credits in your portfolio that may include credit cards, installment loans, mortgages, and other credit types.

Limited credit history or absence of it also makes it hard for you to get loan approval.

Together with the credit shifts, your score also changes. Having an insight into the components that form your credit score will enable you to take steps to boost it over time.

When an unexpected expense springs up, you can’t wait to improve your credit score and see bad credit loans as a last resort. These loans give a second opportunity to the borrowers who are turned down for credit; that’s why bad credit loans are taking a niche market. A Useful Bad-Credit Lender List

We know that some lenders may still reject your request despite what they advertise, that's why we have a list of websites we trust with their acceptance rates. Although, on our website, only a few reasons can give grounds for the lenders for not to approve your request, you may consider the below-mentioned websites if you don't get a loan offer here. | Lender | Learn More | Rating⚹ | Acceptance Rate | Max. Loan Amount |

|  |  | 79% | $2,000 |

|  |  | 81% | $2,500 |

|  |  | 77% | $2,500 |

|  |  | 68% | $2,000 |

|  |  | 75% | $2,500 |

At LoanPlaces, we understand that there may be so many reasons behind your poor credit score. Thus, we consider your current state above the credit history and strive to find timely solutions for your exact case.

Here are the four "No-s" that can best describe our financial products:

No Credit Checks: In contrast to traditional lending entities, our lenders carry out soft credit checks that won’t harm your credit rating and give you a chance to get approval before long.

No Collateral Needed: Bad credit loans don’t require any collateral (car, home). Thus, you avoid property evaluation costs and the risks of losing your assets in the case of any payment defaults. Besides, these unsecured loans are a great relief for those who don’t have an asset to secure the loans.

No Payment Delays: All the transactions are carried out online without long and annoying paperwork and a waste of time! You can take out the loan as soon as you get the approval. Some transfer delays may be connected with your bank.

No Long-Term Obligations: Bad credit loans are usually lent with smaller amounts due on the fixed day in short terms. The maximum sum for bad credit loans is $2500. You get the loan and pay it back within a short period that ranges from two up to five weeks, depending on the lender loan agreement.

In ClosingThe somewhat bad reputation of these loan types comes from the higher interest rates, but when an emergency pops up and the other funding options are limited for you, bad credit loans can be a good option. A little bit higher interest rates may be the price for your saved time and peace of mind. Once decided to take the plunge, carefully read the loan agreement to disclose the APRs and payment terms. After signing the contract, take a responsible approach to pay off debt.

[ Updated on 11-Feb-2021, 02:39 ]