Facing a cash crisis that can’t wait until your next payday? Cheer up, you are not alone.

The latest surveys revealed that almost 40%-60% of Americans live from paycheck to paycheck. So, even a small sudden expense can cause a lot of troubles. Let’s say an unexpected bill or medical expenses suddenly crop up; what can the middle-income Americans do other than searching for quick resources to fill the financial gap? Asking relatives is a good option, but they are not always able to lend you a helping hand when you most need it. Bad credit is another reason for facing difficulties to get funds. If your credit score is lower than 600, you can hardly expect to get a loan from a bank. In such situations, same-day loans may seem the right way out.

Ins and Outs of Same-Day Loans

Same-day loans are fast loans that may be available the same day you apply for them. They are usually lent with a short repayment period. The amount of cash is small, so you can pay off the debt plus interests as soon as you get your salary. You are not tied down to a long-commitment debt contract. The same-day loans may let you borrow from 100 $ to 2500. $ The loan processing is carried out online and will take you less than 5 minutes to complete the request. Then we make your loan request available to many lenders, who get in touch with you after reviewing it.

The Processing Time and Use of the Loan

Be aware that getting approval from the lender doesn’t necessarily mean that you will get the funds right away. The timeliness of money transfer may depend on the lender’s disposition as well as your bank. When you get the cash directly transferred to your bank account, you can do with money whatever floats your boat. The lenders won’t keep track of the spending.

How to Qualify for Same-Day Loans

As a trustworthy lending platform, we aim to help hard-working Americans get the funds to combat financial difficulties. Be sure we don’t make you jump through the hoops as we have set low requirements for approving your loan. If you are 18 and over, are a US resident, employed, or have other sources of income (alimony, pension, any passive income, etc.) and can provide some personal information that includes but may not be limited to a phone number, ID (it may even be a driving license), we will try to help you.

Our financial tools may be an ideal solution for those who:

- Avoid borrowing from relatives or friends.

- Have some credit defaults that hold them back from adhering to traditional lenders.

- Are tired of credit cards (a loan from your credit card that permits getting speedy cash).

Same Day Loans VS Credit Cards

In doubt which of these financial tools is better? Let’s consider the specifics for prioritizing one of them.

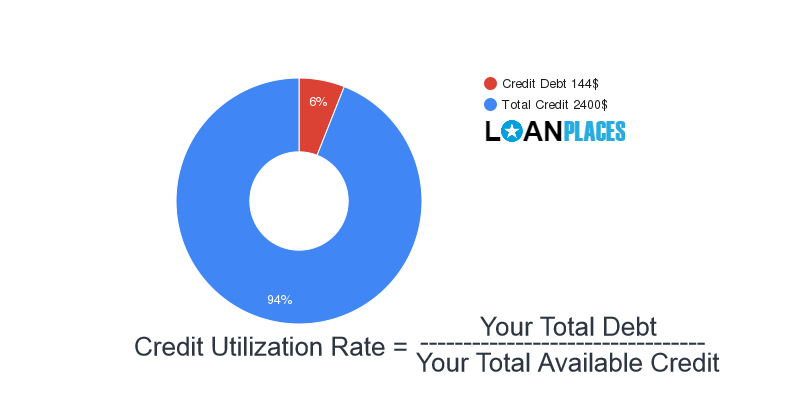

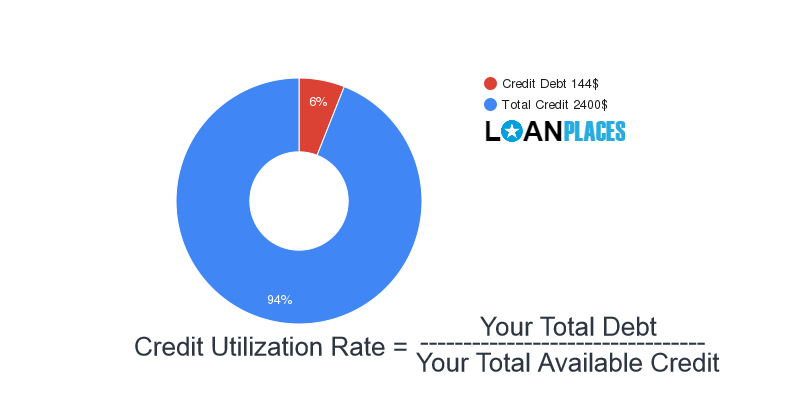

Let’s note that both loan types come with high interests and possible upfront fees for those who want to gain insight into the APRs. The bright side of these borrowings is that you can get quick finance when you most need it. Be informed that credit cards can affect your credit score. How? If you want to cope with credit card debt, you pay it off in a short period, then the amount of the available credit increases. What does it mean? the more available credit, the more you spend. The more you spend, the more you are likely to spiral debts, plus you increase your credit utilization rate. The latter is reckoned by the amount of the total credit available and used debt․ In other words, it is the portion of used credit measured in percentage.

This percentage plays a crucial role in counting your credit score. The less you utilize your credit card, the more beneficial it will be for your FICO score.

When you feel the pinch, it is tough to track your credit card debt, and you can easily damage your credit score by increasing the utilization ratio. What’s more, you can even max out your credit card debt. In contrast, same-day loans are borrowings with fixed amounts; you take out up to 2500 $ and are free to do with borrowing whatever tickles your pickle without the fear of leaving a ‘footprint’ in your credit history. Be aware that same-day loans are not reported in your credit history.

However, there is no sharp distinction to ascertain which of the following types of borrowings is better. Each borrower has different credit scores, needs, requirements, spending habits, and repayment practices. Thus, before applying for one or another loan, you should consider your current situation that embraces your credit score and financial status.

Same-Day Loans for Bad Credit

The terms same-day loans and bad credit go hand in hand, as whenever you think about quick lending platforms, you imagine bad credit loans. Our same-day loan products may be available even if your credit score is far from being excellent. We understand that a bad credit score may not always be linked to the irresponsibility of the borrower. Our lenders may ignore your poor credit if you have proven income now. At LoanPlaces.org, we strive for your convenience and try to find a quick solution to your money issues.

To the Borrowers

Each lender comes with different lending terms, and you had better read the clause of the agreement carefully before signing it. You can cancel the loan agreement if you find uncovered points in it or something that may seem unsatisfactory to you. Once you have decided to take same-day loans, request as much as you need to cover your emergency but always remember that you have to pay it back.

[ Updated on 03-Feb-2021, 01:22 ]